Table of Contents

NFTs, or non-fungible tokens, were all the rage in 2021, but they seem to have fallen out of favor in recent months. However, there is a new breed of NFTs that is starting to gain traction: Bitcoin NFTs.

These NFTs are interesting because all this time we have only majorly heard of NFTs being created and deployed on blockchains like Ethereum and Solana. Bitcoin wanted no part in it.

So, what exactly led to the genesis of Bitcoin NFTs? And why has the blockchain penetrated into NFTs now? Have these NFTs been there for longer than we thought? If yes, why this sudden brouhaha in the market?

🔥 2023’s most popular tutorial 👉🏼 Create a Bitcoin token on Stacks with Clarity

Let us unpack and simplify it all – bit by bit – in this very blog.

Overview of Bitcoin NFTsTo start with, Bitcoin NFTs are complex and a bit controversial, too. The simplest definition of Bitcoin NFTs would be that they are non-fungible tokens on the Bitcoin blockchain. They are minted and generated through an inscription process by employing the Ordinals protocol.

To understand this in detail, it is vital that we first learn about the major upgrades and improvements that have taken place in Bitcoin.

Bitcoin went through a soft fork in 2017 when it introduced Segregated Witness or SegWit to its system. A protocol update, SegWit was a need of the hour for Bitcoin because the blockchain was facing some serious trustlessness issues which the update mended. SegWit put ample focus on the storage of data in Bitcoin.

Source: CryptoPotato

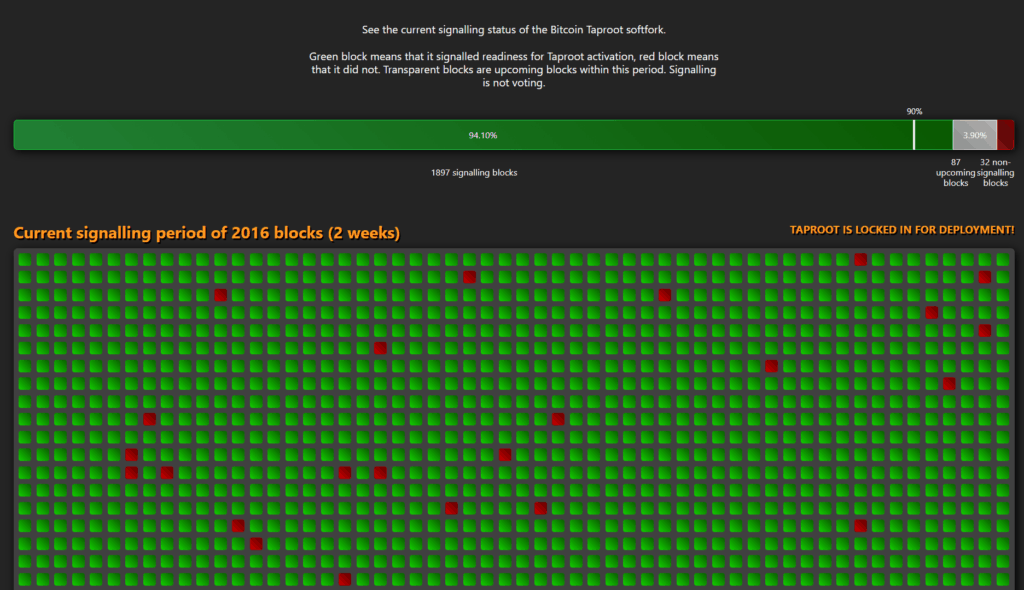

Source: CryptoPotatoFast forward to 2021 a new update, Taproot, was introduced in Bitcoin. Taproot, even though, was brought on to improve the network’s efficiency and privacy, also led to the opening of a bunch of new opportunities for blockchain developers such as to build and deploy applications native to Bitcoin.

The deal-maker (or deal-breaker?), however, has been this function that allows the inscription of data like images and texts into the transaction data (satoshis) that can be exchanged or gifted on the Bitcoin blockchain. This function came with Bitcoin’s latest update, Ordinals, in 2023. And it set everything ablaze. This is exactly what caused the brouhaha in the market.

What are Bitcoin Ordinals?Development on Bitcoin has essentially been a little boring and minimalist, for lack of better words. However, as recently as the start of the year 2023, Bitcoin went all ‘new year, new me’. In simpler terms, it became more animated.

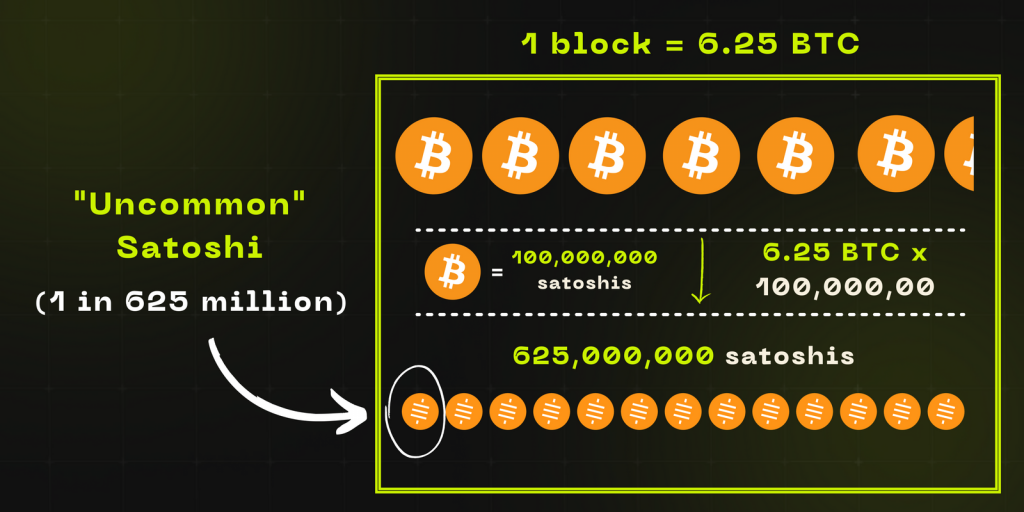

Ordinals played a pivotal role in Bitcoin’s glow up. But how does this THING work? If you are new to the crypto-verse, know that each Bitcoin consists of 100 million satoshis or sats. Named after the developer of the blockchain, Satoshi Nakamato, sats are the smallest units in Bitcoin, 1/100 millionth of a Bitcoin.

The Ordinals protocol essentially opened the pathway for Bitcoin users to individually send sats with additional data like videos, images and texts. This data is known as inscription. Some famous Bitcoin Ordinal inscriptions are Ordinal Punks, Taproot Wizards, and Bitcoin Rocks. As of today, there are two types of Bitcoin fungible token standards created after the Bitcoin Ordinals went viral.

1. BRC-20 tokens

1. BRC-20 tokensBRC-20 is an experimental token standard. Inspired by Ethereum’s ERC-20 token, this fungible token standard was created by a programmer in March 2023 following the disruption in the market caused by Ordinals in January 2023.

The token standard was essentially created to see whether fungible tokens can be hosted on the Bitcoin blockchain. Many BRC-20 meme tokens have been launched since March 2023 and the standard has gained massive popularity.

2. ORC-20 tokensORC-20 tokens are an updated version of BRC-20 tokens within the Ordinals protocol. They’re aimed at addressing and solving some of BRC-20 limitations such as security and flexibility. ORC-20 tokens enhance the fungible tokens on top of a satoshi. Their main aim is to improve backend compatibility of BRC-20 with respect to adaptability, scalability and security.

Compared to BRC-20, ORC-20 tokens have more data inscription options. Moreover, a major problem amongst BRC-20 has been that of double-spending which these tokens also address. Finally, ORC-20 is concerned with increasing awareness about and promoting awareness of Bitcoin Ordinals.

But where did the name Ordinals come from?The Ordinal protocol was developed by Casey Rodarmor. Casey is a software engineer and the creator of different projects as part of the Ordinal theory that use the Bitcoin blockchain for content storage and payments. Thus, Ordinal theory is the source of the protocol. However, Ordinals are not a unique concept. There are different theories that exist in different fields and disciplines.

In blockchain, specifically Bitcoin, Ordinals work like absolute magic. Let’s understand it this way. Bitcoin is a fungible coin. Your Bitcoin looks exactly like my Bitcoin and vice versa. There is absolutely no way to differentiate between both.

This is where the Ordinal protocol comes into play. It assigns a number to each sat of a Bitcoin. This is why they are called Ordinals, deriving from ordinal numbers. What we can take from this is that while Bitcoin as a whole shall remain fungible, the sats inside it will be different because they will have a distinct identity.

Cashing in on this awesome concept, the dad of blockchains has begun its official NFT journey. As of May 2023, 8 million Bitcoin Ordinals have been minted. And all this development in merely a few months traces its roots to the biggest Bitcoin upgrade of the year 2021, Taproot.

What role do Bitcoin inscriptions play?Trusting that now you know what inscriptions are with reference to Bitcoin Ordinals, let us now dig a little deeper into the origin of inscriptions in Bitcoin.

Powered by Ordinal theory via the Ordinal protocol, inscriptions essentially work as metadata inscribed onto a Bitcoin sat. An Ordinal is actually the result of inscribing data – in the form of video, text, image – onto a sat. These inscriptions quite literally can have any information that a sender wants to add in a transaction.

It is also important to understand that satoshis or sats themselves do not have any data. They are like clean slates.

Types of satoshisAccording to OrdinalHub, satoshis have been characterized into 6 different types. These types are based on the supply of satoshis and they denote how rare a certain sat of a Bitcoin is. The different types are as follows.

1. CommonAny sat other than the first sat of the block falls under this category. Estimates suggest that there are 2.1 quadrillion common sats.2. UncommonOpposite of common, uncommon sats are the first sat of each block. There are only 6,929,999 uncommon sats in supply.3. RareThe mining difficulty in Bitcoin increases after every 2,016 blocks. The first sat of each difficulty adjustment period is quite rare to find. Estimates show that there are only 3,437 sats.4. EpicThere is yet another rule in Bitcoin called halving. In halving, after every 210,000 blocks are mined, the overall reward for the miners gets halved. Thus, the first sat after each halving or after every 4 years is epic. There are only 32 of these as per some sources.5. LegendaryThere are four market cycles in blockchain. The first sat of each cycle is called legendary. There are only 5 legendary sats in total.6. MythicThe first sat of the genesis block – the first every Bitcoin block to be mined – is called mythic. There can only be one mythic sat in Bitcoin. Source: OrdinalHubKey characteristics of Bitcoin NFTs

Source: OrdinalHubKey characteristics of Bitcoin NFTsNow that you know that Bitcoin NFTs are new and quite unique in their workings, here are some characteristics that will paint a clearer picture for you about them.

1. Ownership and uniquenessMuch like Ethereum or Solana NFTs, Bitcoin NFTs represent uniqueness. The key factor here is the numbers assigned to them through the Ordinals protocol. Each sat or Bitcoin NFT has a distinct code and metadata which makes it identifiable.

2. IndivisibilityYet another key characteristic of Bitcoin NFTs is that they are indivisible meaning that they can not be divided. This is a characteristic of almost every non-fungible (something that is unique and can’t be replaced) token. There could be no replications of an NFT. Thus, in literal and practical terms, there could be only one owner.

3. Immutable history and provenanceImmutability is amongst those Bitcoin characteristics that remain uncompromised and unchallenged. Everything that goes on with a Bitcoin or the blockchain is recorded and readily available to the blockchain to access. Same applies to Bitcoin NFTs. Its inscriptions are immutable.

The origin of Bitcoin NFTsNow that you have some valuable and fundamental knowledge about Bitcoin NFTs, let me give you a shocker. Bitcoin NFTs actually predate NFTs. The blockchain launched its first Non-Fungible Token in September 2016 by the name of Rare Pepe.

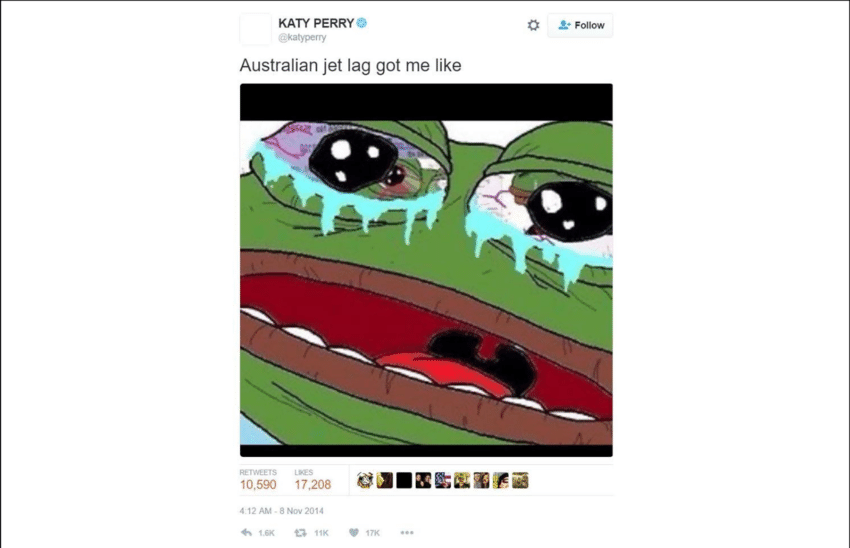

The Rare Pepe collectibles can be considered the father of NFTs. In fact, Rare Pepes walked so that NFTs could run. While many of us may not know Rare Pepe by name, we have all seen it, as a meme, somewhere on the internet and chuckled. And we can probably recognize it in a second.

Here’s Pepe to refresh your memory.

Source: Buzzfeed newsThe birth of Rare Pepe

Source: Buzzfeed newsThe birth of Rare PepeThe character of Pepe was created as Pepe the Frog back in 2005 by cartoonist Matt Furie for his magazine called Playtime. The character got prominence with Furie’s comic series, Boy’s Club, which revolved around the day-to-day lives and adventures of four slacker roommates.

Like many of the terms that are widely used within the crypto community (examples include NGMI, WAGMI, LFG, etc.), Pepe further rose to the occasion and gained immense popularity and fame within online bodybuilder and anime communities. This was a result of Furie posting the comic pictures on his MySpace account.

For the frog, however, things was only getting started. Pepe became a celebrity in 2014 when Nicki Minaj and Katy Perry posted its memes. The positive popularity, though, was short-lived as it soon got hijacked by some people who used it as a hate symbol.

Source: ResearchGateHow did Pepe the Frog become Rare Pepe?

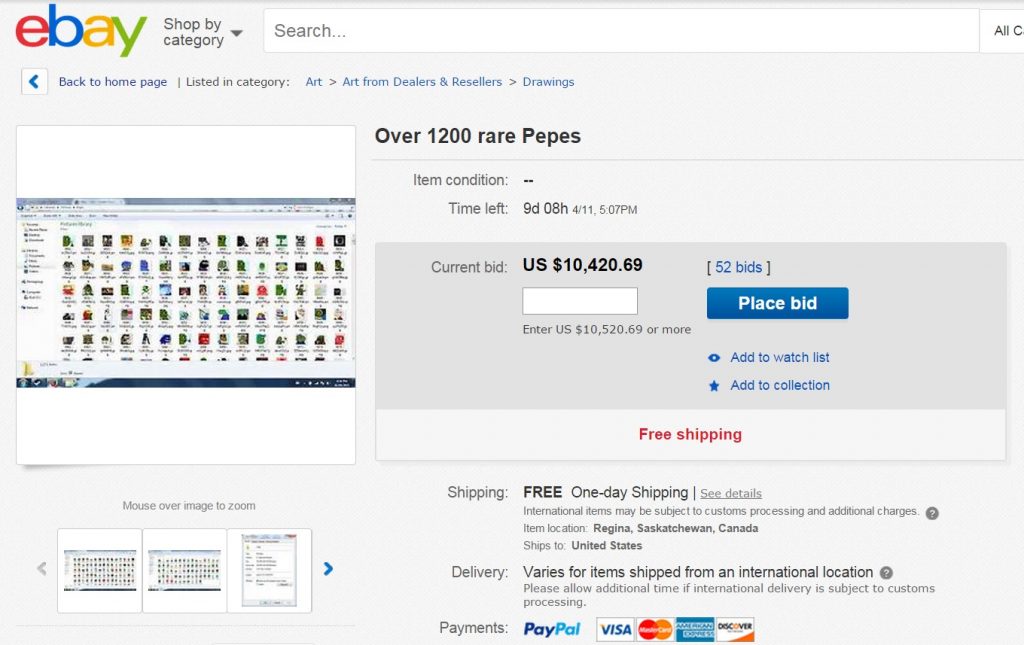

Source: ResearchGateHow did Pepe the Frog become Rare Pepe?Given the popularity of Pepe the Frog, how it got shared by celebrities and how it was used as a hate symbol later on – a new variation of Pepe called Rare Pepes came to the surface on a website called 4chan.

Soon thousands of different Rare Pepe memes were listed on eBay and Craigslist. In fact, as per some sources, the price of Rare Pepes reached almost a 100 grand on these marketplaces before they were taken down.

Source: Danero Berts on WordPress

Source: Danero Berts on WordPress To Bitcoin’s luck in 2016 Mr Pepe somehow ended up as an NFT on Counterparty – a layer-2 Bitcoin solution similar to Stacks – that assists the parent blockchain (Bitcoin) in its functionalities such as scaling, security, etc. and power its NFTs and DeFi applications.

Soon Rare Pepe became a part of the blockchain ecosystem. They looked like trading cards and were minted in very limited amounts. The NFT had a special wallet by the same name i.e. Rare Pepe wallet which users could use to buy, sell, store and exchange their Rare Pepe NFT cards. Moreover, Rare Pepe trading was done by a liquid cash card called PepeCash.

This was the time when the term NFT was sparely used and Ethereum NFTs were in the distant future. Bitcoin, thus, can be called the accidental pioneers of modern-day NFTs. The first Rare Pepe NFTs were minted on Bitcoin’s 428,919th block. And this is how Bitcoin NFTs originated.

How are Ordinals different from NFTs?While Ordinals and NFTs share some similarities in being immutable, non-fungible, and unique, their nature and application set them apart.

Ordinals possess a dual nature, whereas Bitcoin NFTs are strictly non-fungible. Let’s consider a scenario: Bitcoin consists of numerous satoshis, and the Ordinals protocol allows a sender to choose whether to inscribe data onto a satoshi and include it in the transaction or leave it as is.

In the former case, when the sender inscribes data onto a satoshi and sends it, the Ordinal becomes non-fungible and unique. However, in the latter case, when the sender chooses not to inscribe anything on the satoshi and sends the transaction, only a fungible Bitcoin is sent.

Solana and Ethereum NFTs, however, are completely different from Solana and Ethereum coins and are not related to each other.

Another super interesting thing about Bitcoin Ordinals is that they are limited. There can only be 2 quadrillion satoshis in the entire Bitcoin blockchain. This is because there can not be more than 21 million Bitcoins. Each Bitcoin has a 100 million satoshis.

This exponentially increases the demand of Ordinals while the supply remains constant unlike what is the case with Ethereum.

Who can mint a Bitcoin NFT?There are two ways to go about this. The first way is to run a node. This can be a time-consuming, energy-heavy and resource-intensive process because running a node requires lots and lots of computational power and storage. It can take days to set up and may also require you to know a thing or two about blockchain technology.

The second way is to use a no-code inscription tool called Gamma which allows you to easily and casually mint an NFT. It can be a bit tricky in parts. However, we’re gonna show you how it’s done.

How do I mint my own Bitcoin NFTs?Before this subsection provides you a step-by-step guide on how to mint your own Bitcoin NFTs, it is important to bear in mind a few things.

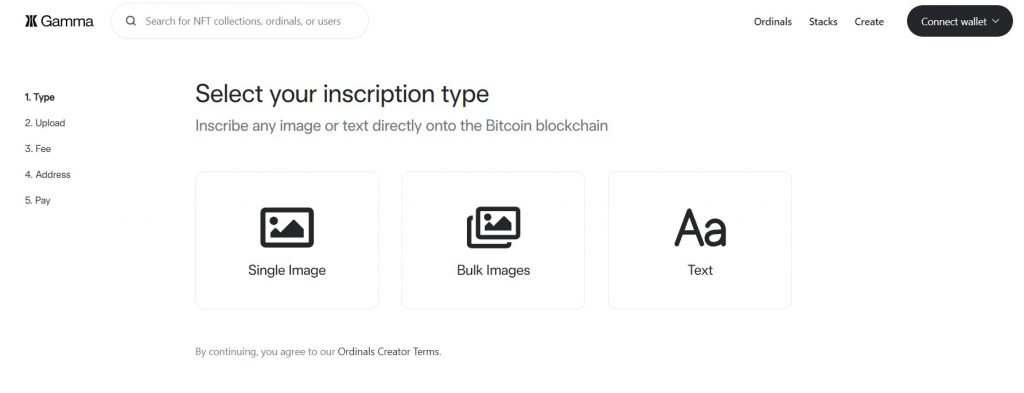

You will be using a no-code inscription tool called Gamma.ioYou need to have at least $50 worth of Bitcoins in your wallet to pay for the inscription feeThe wallet you are using must be compatible with Taproot address (Muun, Sparrow and Spectre wallets are some good examples)Lastly, know that Coinbase and Binance do not support Taproot addresses1. Now, go to the no-code inscription toolYou will need to go to the official website of Gamma i.e. https://gamma.io/ordinals and land at its Ordinals page. You’ll be able to see a similar page like the one shown below.

The Ordinals page of Gamma.io2. Choose the inscription type

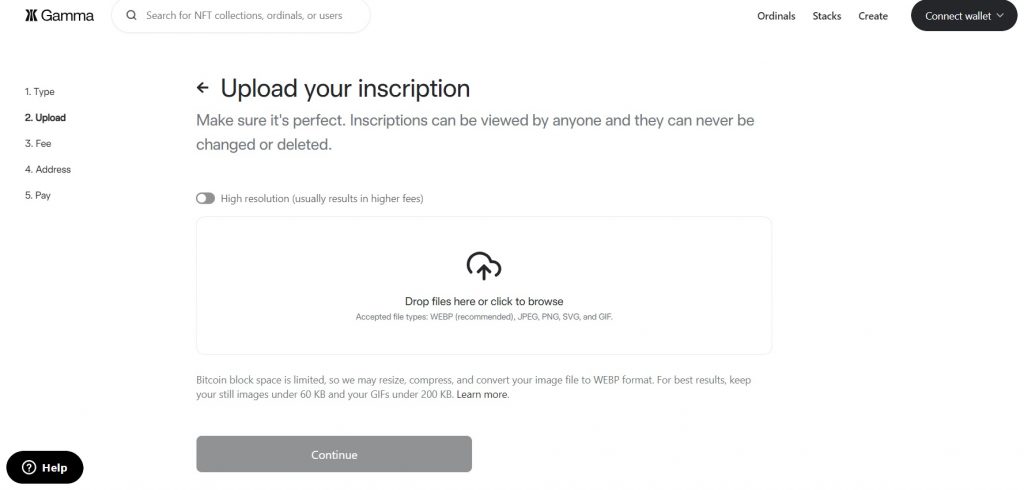

The Ordinals page of Gamma.io2. Choose the inscription typeBased on what you want to inscribe onto your Bitcoin sat, choose your inscription type. Once you have chosen, you will see the following window.

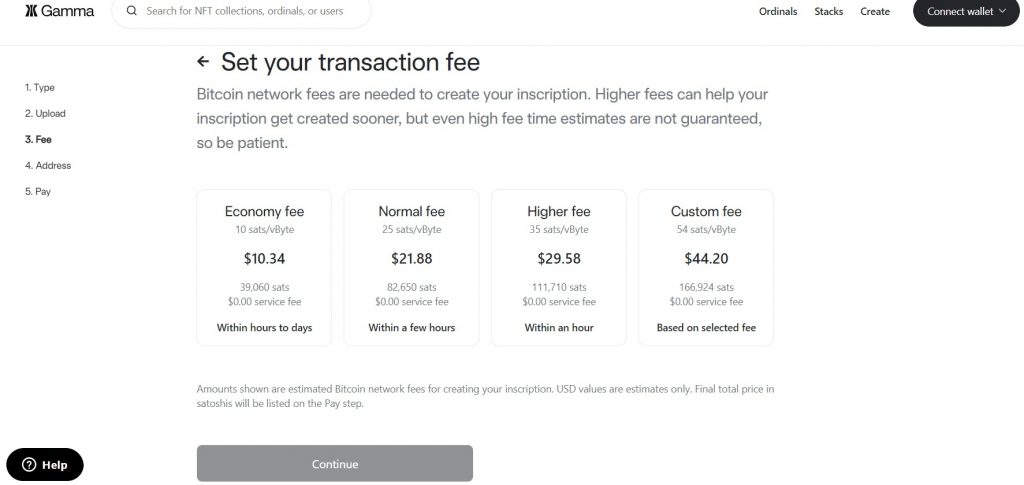

Upload inscription in the selected inscription type3. Choose your fee plan

Upload inscription in the selected inscription type3. Choose your fee planThe next window after uploading your inscription will be to choose a desired fee plan that suits you.

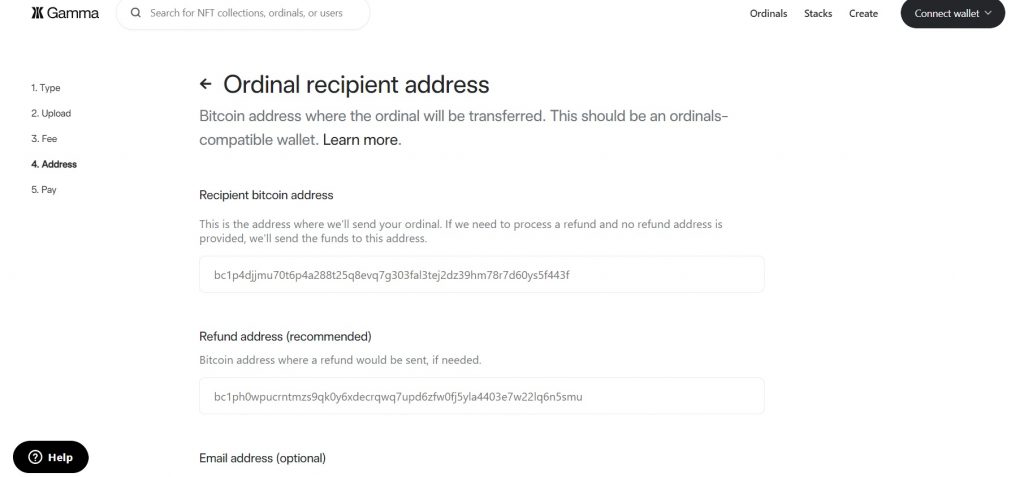

Set your transaction fee by choosing one of the fee plans4. Get your Ordinals’ recipient address

Set your transaction fee by choosing one of the fee plans4. Get your Ordinals’ recipient address The Ordinal recipient address page

The Ordinal recipient address pageAs was mentioned in the beginning of this guide, there are a few tricky things when using the no-code inscription tool, Gamma. It is recommended to use Sparrow wallet, one of the three wallets mentioned above. Once you get your Sparrow wallet address, you can input it in the “Recipient bitcoin address” field.

5. Add Taproot address prefixAll Taproot wallet addresses have a prefix. They all start with bc1p and that is how they stand out. So make sure that your wallet address has the prefix too.

6. Proceed with the paymentYou may now send your chosen transaction fee plan to the indicated wallet address. But be very careful with it. The address should start with the prefix bc1p.

Some also recommend sending the Bitcoin for the inscription payment from a different wallet than the one receiving your Ordinal NFT to avoid any hassle and mistakes.

7. View your Ordinal in an Ordinal viewerBased on the fee plan you chose, you will have to wait for a few days. You will instantly receive a link on your email to track your Ordinal. Once the wait is over, you may view your Ordinal in an Ordinal viewer.

And that’s it, you’ll have successfully minted your Bitcoin NFT. 🎉

Use cases of Bitcoin NFTsIt’s important for their adoption that Bitcoin’s NFTs are or could be seen in practical use. Here’s how that’s coming along.

1. Art and collectiblesBitcoin Ordinals can be used as art and collectibles just like NFTs. Budding and passionate artists can monetize their work on the Bitcoin blockchain and sell their art directly to collectors.

2. Gaming and virtual worldsBitcoin NFTs can also be used to represent ownership of virtual land or for real estate purposes. Virtual spaces and immersive reality are becoming quite popular these days. Bitcoin NFTs or Ordinals can come in handy here.

Moreover, they can also be integrated into blockchain-based games and consequently allow players to own their game assets in a digital format outside of the gameplay.

3. Intellectual property rightsThe NFTs can be utilized to establish and manage intellectual property rights. This can happen through the tokenization of the creations which include NFTs. By doing so, it will help creators a great deal for proving ownership and having control over their intellectual property.

How the future looks like for Bitcoin OrdinalsWe are living in exciting times (and confusing for some). There is quite literally a new asset class being generated in the crypto world. This class is Bitcoin Ordinals with a market cap of billions of dollars. On one hand, the market is down and in a state of crypto winter, on the other hand, crypto experts see a lot of opportunities.

Experts also believe that the rapid tokenization of Bitcoin can prove to be great for Bitcoin miners. Many are even referring to the Ordinals protocol as the Bitcoin flippening. In fact, Ordinals have been so strong that its emergence has extensively increased a miner’s fee of 6.25 BTC for mining a block.

While Ordinals have some proponents, many consider them yet another example of an unsustainable project and a one-off thing. Only time will tell whether the Ordinals are here to stay.

And to sum it all up,

Bitcoin NFTs are basically inscriptions on the smallest Bitcoin unit – satoshi or sat – which results in what we call Ordinals. Ordinals have a unique identity as they are given a numerical code which sets them apart.

All of this is a result of a Bitcoin update, Taproot, that took place in 2021. In simple terms, the update made it possible to develop smart contracts and dApps on the Bitcoin blockchain, expanding its horizons and scope and consequently, making the blockchain more happening.

The Ordinals system is recent and a result of the Ordinal protocol which derives itself from the Ordinals theory. It has definitely set everything ablaze. As of May 2023, 10M Bitcoin Ordinals have already been minted.

Albeit a little controversial, Bitcoin NFTs are still in their early stages and can be a great case study and a source of lessons in the blockchain ecosystem.

FAQsWhat is the difference between satoshis and Ordinals?Ordinals and satoshis can not have a comparison because they are two different things. Bitcoin Ordinals come from the Ordinal theory which forms the Bitcoin protocol. This protocol is responsible for numbering satoshis and transferring them into Bitcoin NFTs. Satoshis are the smallest Bitcoin unit. 100 million satoshis make up one Bitcoin.

Are Rare Pepes non-fungible?Yes, Rare Pepes which went viral in 2014-2015 and were on a layer-2 Bitcoin solution, Counterparty, where they were traded as non-fungible tokens.

How to mint a cryptocurrency?The minting of cryptocurrency depends on which blockchain’s currency you want to mint. If you want to mint ETH, you would have to stack and pledge at least 32 Eth and become a validator. If you want to mint BTC, you would have to mine blocks and then you would get rewarded with 6.25 BTC for each block.

Are Bitcoins fungible?Yes, Bitcoins are absolutely fungible.

What are Ordinals?The Ordinals are a method for tracking satoshis in Bitcoin by assigning them numbers.

What is the maximum file size for attaching an image to a satoshi?According to OpenSea, the file size for an NFT should be well under 100 MB. As far as the Ordinals are concerned then the no-code tool Gamma recommends that still images be under 60kb and GIFs under 200kb for better results.

Where can I track or see BRC Ordinals?There is a website called ordspace.org/brc20 which you can use to get information about BRC Ordinals.